The impacts of Covid-19 have taken a toll on Nigeria’s economy as with others, globally. Nigeria’s situation, though not isolated, is pathetic given the fact that its main source of revenue, crude oil, is badly affected, with the resource losing, as at the last count, over $25 on its price, reports Group Business Editor, SIMEON EBULU.

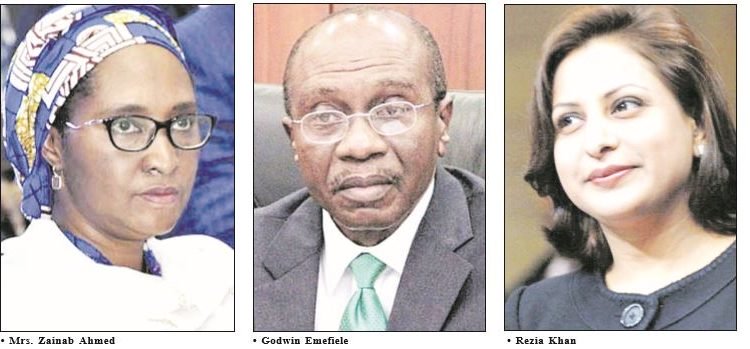

It was Rezia Khan in early February who first sounded the alarm somewhat of dire consequences for the Nigerian economy of the impact ot the Coronavirus pandemic, weeks before it dawned on the authority that danger was lurking at the corner. Khan, who spoke in Lagos on the theme: Nigeria in 2020 -Economic Outlook, said the Covid-19, which unvleashed its deadly fangs first in China, has led to the downward review of China’s growth to 4.5 per cent from the previously held forecast of six per cent.

She spoke extensively on the linkage between the events happening then in Wuham, China’s industrial manufacturing hub and its impacts on the global economic sphere. And because the ripple effects of that unfolding development could not be conceptualised, as no one imagined that could get to what it is today, the full weight of its impact on humanity and its devastating effects the economy could not by any stretch of imagination be fathomed out as it is today. Nevertheless, she gave some insightful thoughts.

She said the scale down by about 80 per cent of air transportation arising from aviation travel ban to mainland China by major international airlines, with the obvious decline in demand for aviation fuel, as well as the decrease in oil demand arising from severe drop in manufacturing, as well as major factory and business closures and the continuing drop in oil prices (Nigeria’s main revenue earner), are signals that the country’s economy will be in dire straits and at the receiving end.

That obviously is exactly what the situation is now and going from bad to worse. Things have happened so fast as she predicted that there is little or no room for government to address one occurrence before another sets in. The demand for oil has not only shrank, the price has plummeted. From a high of above $65 per barrel in February, the price has dropped to about $29 per barrel, with fears that it might drop to as low as $15 per barrel. It is not only Covid-19 that is at play here, the ego trip of producing giants such as Saudi Arabia and Russia, is also fuelling the price war, both countries having failed to agree on a production cut at the last Organisation of Petroleum Exporting Countries (OPEC) meeting in Vienna, has driven Nigeria’s economy into a trap and a cul de sac. Today, Nigeria’s crude is sitting akimbo in the high seas without buyers, and if any, at a price almost at par or below production cost.

Implication

The big question obviously is, what Nigeria should do, especially in the context of the prevailing weakness in oil price. Expectedly, investors are on edge looking at the direction of the foreign exchange reserves which at the moment do not offer much hope. The challenge of even building the reserves is clearly herculean and with that comes the problem of exchange rate sustainability. If foreign investors get nervous (I’m afraid they already are), and develop cold feet when it comes to investing, or even retaining their existing portfolios in the country, they might therefore in return demand a higher risk premium from the country. They want to know if they would get a higher return because of the obvious higher and attendant risks. And this could well emerge as something, or a challenge that the monetary authorities will have to look at.

Oil dependency

There are certain peculiarities about the Nigerian economy that when benchmarked against the prevailing Covid-19 pandemic, expose the underbelly of the economy and the danger a mono-economy like ours presents. Firstly, the economy is oil dependent, sadly and most regrettably, everything that is derived from the oil as revenue, is shared wholesale as quickly as it is earned as allocation to all the three tiers of government. It is a matter of conjecture whether anything is left as savings, or invested for posterity. There is the Excess Crude Account (ECA) that ought to act as a buffer, but in the light of the dip in oil prices, even before now, that ECA had since lost its meaning.

The economy has been hurt over time by dwindling oil prices, this Covid-19 pandemic should present the country a great opportunity for diversification. The reality, Rezia Khan feared, is that Nigeria hasn’t yet necessarily seen that happening in a strong way. What is needed, she counseled, is for Nigeria to move away from oil, stressing the need to be more economically deep outside just the allocation model of the country.

At the last Monetary Policy Committee (MPC) meeting, the Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, called on the Federal Government to cut the Federal Accounts Allocation Committee (FAAC) allocation, saying it was time to start rebuilding fiscal buffers. Given the accumulation of higher debt so far, if the country doesn’t get this right, then the risks will be significant. Because unless we start to see much more focus on revenue numbers, revenue growth that is at least consistent with the double digit rate of inflation, as the inflation figures for February have shown (12.02 per cent), then investors may start to worry about the debt matrix, as well as the amount of debt service relative to the amount of revenue that can be collected, and that is very important, Khan warned.

2020 Appropriation

As oil price continues on its downward slide, Nigeria’s budget of over S10 billion is already a nullity given that it was benchmarked on oil price of $57 per barrel. The Federal Government has already taken notice of that and has taken remedial steps by adjusting its estimates accordingly. The government has consequently adjusted the budget oil benchmark to $30 per barrel from $57, followed by a raft of other measures, including a cap on recruitment of workers. Additionally, President Muhammadu Buhari has approved a N1.5 trillion reduction in the 2020 budget to fit into the present economic realities occasioned by Covid-19.

As the Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed puts it at briefing, “government is working on a worst scenario oil benchmark of $30 per barrel at 2.18 million barrels per day.” She said Buhari has also approved far-reaching measures to face the current economic realities, including a cut on the size of the federally funded upstream projects by N457 billion, reduction of projected revenue from Excise Duty, cut on Capital Expenditure by 20 per cent, reduction of Recurrent Expenditure by 25 per cent, ban on recruitment except for essential services and the review of social investment programmes, among others.

As far reaching as these measures are, she assured of job security for existing workforce, saying government was not considering downsising staff, or a cut in the salaries of civil servants.

“What we have done is that we have written every ministry and given them guidelines on how these adjustments will be made to enable us have detailed imputes. The bulk cut is about N1.5 trillion reduction in the size of the budget. And this includes N457 billion from PMS under-recovery,” she said.

On how much it affects the federally-funded upstream projects, the minister said: “It is about 25 percent cut. The exact amount we will work out when we get inputs from the ministries, departments and agencies.”

Recession looms

With the pervading impact of Covid-19, spanning all spheres of human existence, ranging from economy, sports, travels, tourism, communications and energy, among several others, it is almost certain that the economic fortunes of nations will suffer huge losses. The safeguard against this scenario, going forward, is if a miracle happens and a cure is immediately found for Covid-19.

In recognision of this bleak scenario, Mrs. Ahmed has somewhat admitted that recession is not farfetched. On concerns of the economy slipping back into recession, she said: “Of course we have concerns. This is resulting in about 40 to 45 per cent reduction and also it will affect the states because it means FAAC will be significantly reduced. We are expecting the states to take similar measures to amend the plans that we have made and bring them down to current realities. “It is just a question of deferring some nonessential expenditure so that when things turn, we might actually go back to our plans.”

CBN’s intervention

As part of its developmental function, the CBN has risen to the challenge of Covid-19 pandemic, by providing N1 trillion intervention for businesses and households that have come under the trauma of the pandemic. Emefiele, said the increase in the intervention is intended to boost local manufacturing and import substitution across all critical sectors of the economy.

This is in addition to the N100 billion in loan in 2020, to support the health authorities and to ensure that laboratories, researchers and innovators work with global scientists to patent and produce vaccines and test kits In Nigeria to prepare for any major crises ahead.

Emefiele said an Implementation Committee that will action the private sector contribution of N1.5trillion Infrastructure funding and that will link farming communities to markets as agreed at the recently concluded “Going for Growth” Roundtable will be set-up.

Exchange rate adjustments

One of the fallouts of Covid-19 impact was adjustments in exchange rates of currencies at the parallel forex markets. The parallel market dealers had taken advantage of the situation to hike the rates, a development the CBN frowned at and quickly took measures to correct, warning all such perpetrators of the legal implications attendant to such practices.

With Nigeria’s naira official exchange rates fixed by the central bank, these black market operators often deliver a more accurate verdict on the levels of supply, demand and prices. Over the past two days, naira to dollar exchange rates—which have stayed quite stable at around 360 naira to the dollar since mid-2017—have reached 430 naira. One currency trader tells Quartz Africa dollars are literally no longer available even on the black market due to “excessive demand.”

At other levels, high net worth individuals, even accessed the market in search of forex as a store of value and an hedge against a feared devaluation, or depreciation of naira, the local currency.

SOURCE: https://thenationonlineng.net/covid-19-puts-budget-2020-economy-on-edge/